Understanding the Impact of Low Mortgage Rates on Younger Households and Sales Forecast Goals

Orignal Content:

- Researcher: John Burns – Research & Consulting.

- Reported by: Qualified Remodeler – 2023 Remodeling Outlook.

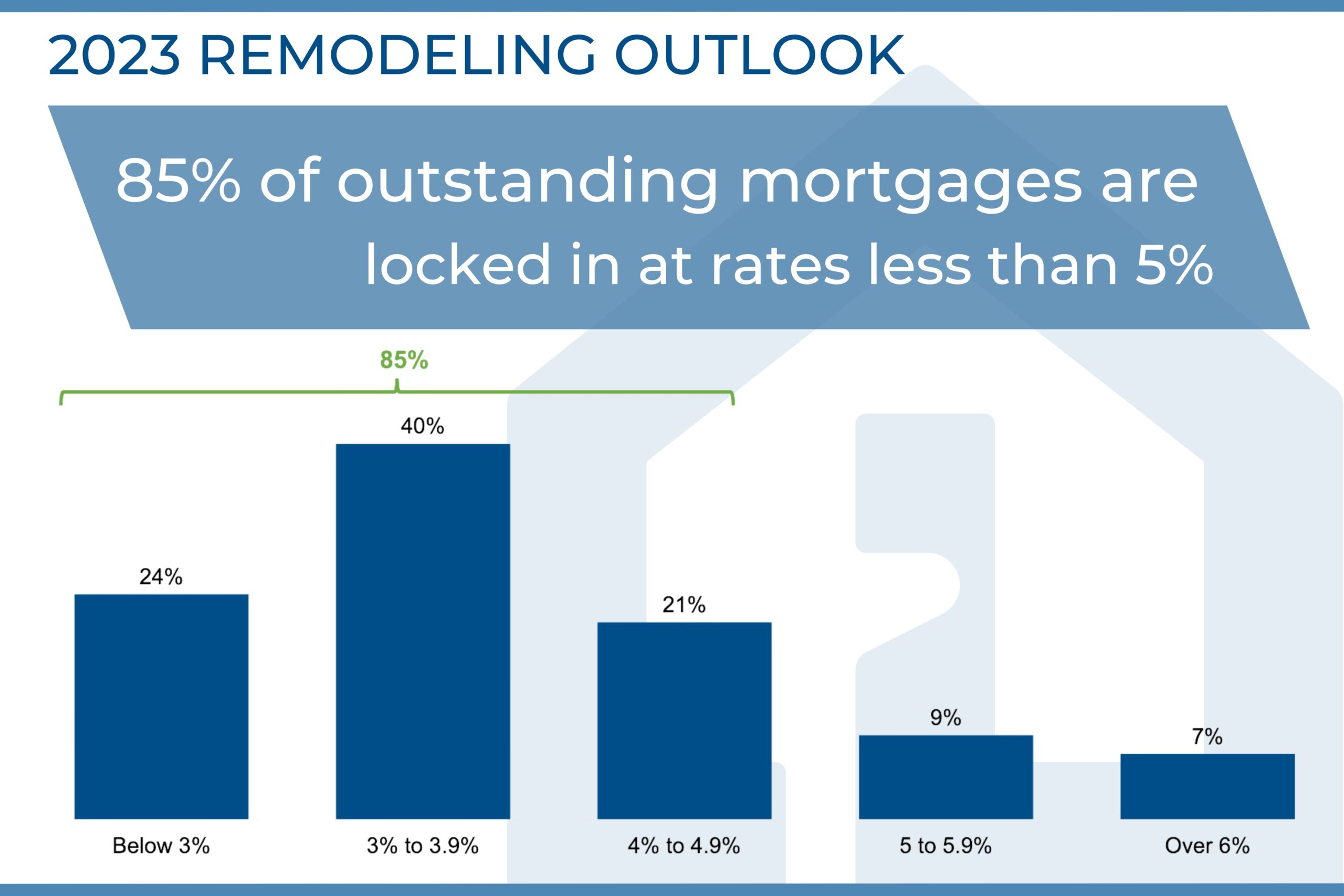

In recent years, the housing market has experienced a significant dynamic that has had a profound impact on many younger households and businesses alike. With approximately 85% of outstanding mortgages locked in at rates below 5%, the implications for homeowners and the overall economy are far-reaching. This article aims to delve into the effects of low mortgage rates on young households and explore how businesses can leverage this trend to achieve their sales forecast goals.

Stability and Affordability for Young Households

For younger households who recently secured a mortgage, the prevalence of low interest rates is a game-changer. These historically low rates have led to stable mortgage payments, ensuring predictability and easing the financial burden for homeowners. The reduced cost of borrowing also translates to increased affordability, enabling more young individuals and families to enter the housing market, thereby driving demand.

Refinancing Opportunities and Home Equity Growth

The current low-interest environment has presented excellent refinancing opportunities for homeowners with adjustable-rate mortgages or higher fixed rates. By refinancing at lower rates, homeowners can reduce their monthly mortgage payments, freeing up funds for other financial goals or investments. Additionally, lower interest rates accelerate the growth of home equity, allowing homeowners to build wealth through property ownership at a faster rate.

Impact on the Economy

The widespread availability of low-interest mortgages has not only boosted the housing market but also had broader implications for the economy. Increased homeownership and reduced mortgage costs have stimulated consumer spending and confidence, driving economic growth. This positive impact can extend beyond the housing sector, influencing various industries and contributing to overall economic stability.

Leveraging the Trend for Sales Forecast Goals

Businesses looking to achieve their sales forecast goals can capitalize on the current housing market dynamics. As more individuals and families become homeowners, there are opportunities to target this growing demographic with relevant products and services. Real estate professionals, home improvement companies, and home service providers are just some examples of businesses that can benefit from this trend.

Navigating Potential Risks

While the current low mortgage rates offer numerous benefits, businesses and households should be vigilant about potential risks. Interest rates are influenced by economic conditions and monetary policies, making them subject to change. A sudden increase in rates could impact affordability and demand in the housing market, affecting sales projections for related industries.

The prevalence of low mortgage rates below 5% has been a transformative factor for many younger households and businesses aiming to achieve their sales forecast goals. Stable payments, affordability, and opportunities for refinancing and home equity growth have provided a strong foundation for economic growth and financial stability. Businesses should carefully strategize and leverage this trend to tailor products and services to meet the needs of an expanding homeownership demographic. Moreover, staying informed about market trends and consulting experts will enable both homeowners and businesses to make wise decisions in a dynamic economic landscape.